.png?width=1600&height=500&name=TMU%20March%202%20blog%202026%20(2).png)

Manufacturing Output Shows Modest Growth Amid Sector Divergences

Manufacturing production posted a slight gain in August, offering a mixed but important signal for freight demand and industrial activity. Total manufacturing output rose 0.2% month-over-month (m/m) and was 0.9% higher year-over-year (y/y). While the overall trend is steady, the details reveal sharp contrasts across key subsectors.

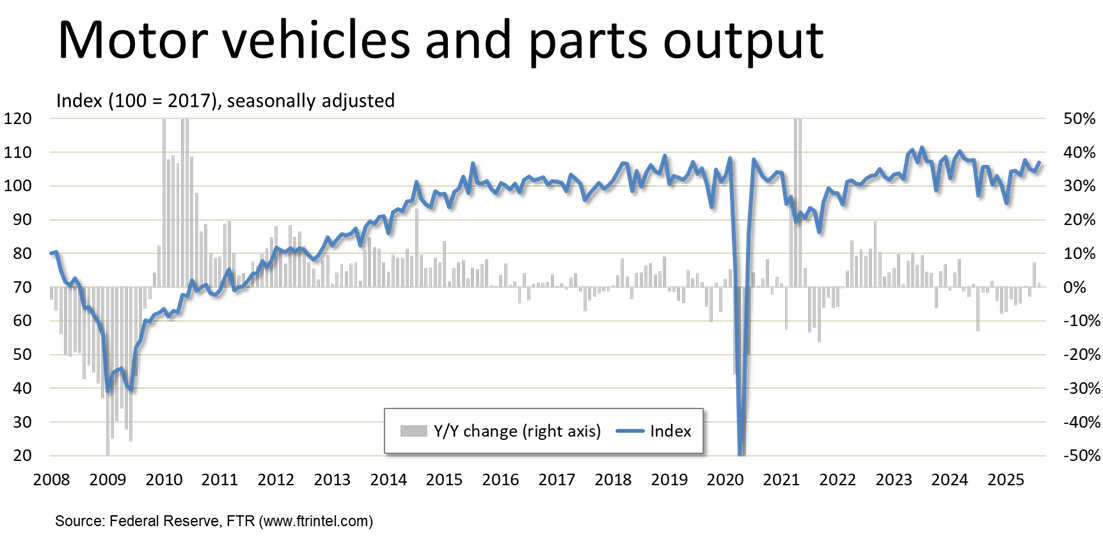

Automotive Leads Durables in August

Among the durable goods sectors, the standout performer in August was motor vehicles and parts:

- +2.6% m/m, driving much of the overall increase in durable goods production.

- Excluding automotive, total manufacturing output still rose m/m but only by 0.1%.

- However, much like vehicle sales, auto production has been volatile. Output for the year to date is down nearly 2%, although production is basically flat y/y since Q1.

- Lean retail inventories due to stronger-than-typical sales support stronger production, but that same tariff avoidance "pre-buy" coupled with higher costs raise worries over demand destruction in the automotive sector.

Don't miss this FREE webinar!

In It Together

Softer Demand in Other Key Durables

While automotive output rose, other core segments were weaker:

- Fabricated metals and machinery posted declines, suggesting still-soft demand for capital goods with one big exception discussed below.

- The decline in fabricated metals was tiny, but it represents a large share of output.

- Durable goods production overall rose just 0.2% m/m and was up 1.5% y/y.

- Businesses apparently remain cautious in their investments due to ongoing uncertainty and concerns about economic strength.

Nondurable Goods Provide Steady Support

On the nondurables side, growth was modest but broad-based in August:

- Production of nondurable goods increased 0.3% m/m and 0.7% y/y.

- Gains were led by textile mills and petroleum and coal products.

- Chemicals output rose 0.3% m/m, which traditionally has been seen as a good sign for industrial production. However, pharmaceuticals and medicine production continues to outpace the rest of the sector.

- Excluding pharma, chemicals output fell 0.6% m/m. Total chemicals output was up 3.0% y/y in August; excluding pharma, output was up 0.9%.

Electronics: Another Upside Outlier

Pharmaceuticals and medicine are the most consistently positive driver of nondurables manufacturing production. Computer and electronic products are the standout in durables and capital goods. Increased domestic output due to incentives like the CHIPS Act and the surge in demand for data centers are key drivers.

- Output has risen for nine straight months, which is unusual in manufacturing.

- Computer and electronic products production was up 6.7% y/y – far stronger than the tepid increase in overall manufacturing output.

- The sector shows no signs of slowing down, but growth logically must slow. For example, the electric power generation needed to support the surge in data centers is an inevitable constraint.

For more insights like these, be sure to catch the FTR Trucking Market Update podcast each week, where we break down the latest trends shaping freight and driver capacity. 📊 Download the full podcast deck and listen to Episode 332 at ftrintel.com/trucking-podcast.

Key Takeaways for Freight and Supply Chain Planning

- Automotive was a strength in August, but it is not dependable. Lower financing costs might bolster purchases of autos and light trucks a bit, but the sector has experienced a "pre-buy" of vehicles as consumers rushed to avoid tariff-relate price hikes.

- Capital goods softness in machinery and metals reinforces understandable uncertainty in business investment due to lingering concerns about unintended consequences of tariffs and weak employment growth.

- Consistent strength in production of chemicals and electronics and pharmaceuticals and medicine highlight structural growth drivers. However, while these are high-value goods, they produce less freight than food, automotive, machinery, metals, etc.

- For freight markets, this mix points to uneven demand across commodities, requiring shippers and carriers to monitor subsector trends closely.

Join industry leaders on November 4, 2025, in Houston for the FTR State of Freight: Chemicals & Petroleum Symposium—a one-day, deep-dive into how shifting trade, equipment markets, and economic forces are reshaping freight. Designed for shippers, carriers, and procurement professionals, this small-group forum blends expert forecasts with candid discussion to help you make smarter investment decisions.

Get the insights you need to make smart business decisions.

Together, Truckstop and FTR break down big data to deliver information you can use to maximize your profits.

- Weekly predictions and capacity

- Equipment and lane data

- Trusted names, trusted partners

Sign up for Spot Market Insights, the trucking industry’s weekly wellness report.

https://truckstop.com/product/spot-market-insights/

.jpg?width=1200&length=1200&name=2025%20FTR%20SOF%20Symposium_LI_1-1(1).jpg)