Winter Weather Ignites the Spot Market

The first full week of February delivered one of the most dramatic spot market moves in recent years, driven less by underlying demand shifts and more by severe winter weather disruptions. In Episode 350 of FTR’s Trucking Market Update, the data tells a clear story: short-term shocks can still overwhelm seasonal patterns—at least temporarily.

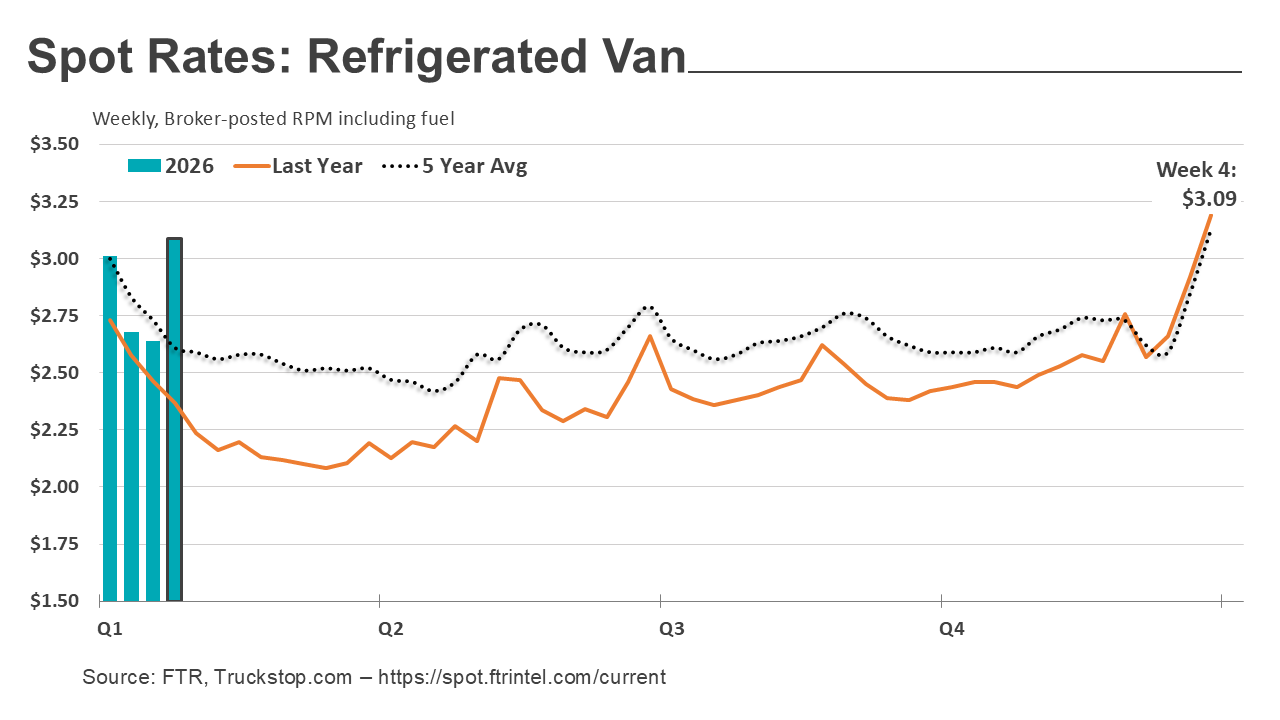

Spot Market: A Rare Week 4 Surge

Week 4 is typically a period of rate softness, but this year broke the mold.

- Refrigerated spot rates jumped 45 cents, the largest single-week increase on record (back to at least 2008).

- Dry van rates surged 20 cents, the third-largest weekly increase on record.

- Total broker-posted spot rates rose more than 9 cents, reaching the highest level of the year.

Week 4 rate increases of this magnitude are historically rare. Over the past decade, both dry van and reefer rates almost always decline during this period.

Don't miss an episode!

Load Volumes Confirm the Disruption

Rates weren’t moving in isolation—volume confirmed the disruption.

- Total spot load postings increased 17.4% week over week

- Dry van loads rose 39.3%

- Refrigerated loads jumped 51.1%, an extraordinary increase for a non-holiday week

- Load volumes were nearly 56% higher year-over-year, with especially strong gains east of the Rockies

The geographic concentration reinforces the weather narrative, with the Midwest and Northeast showing the largest increases in both rates and volumes.

For all the latest information on spot market rates go to https://spot.ftrintel.com/current

Carrier Population: Stabilization, Not Acceleration

Despite the spot market volatility, carrier entry and exit data suggest a more stable underlying structure:

Despite the spot market volatility, carrier entry and exit data suggest a more stable underlying structure:

- New carrier authorizations in January were nearly identical to January 2025

- Revocations fell sharply from December, normalizing after calendar distortions

- Net carrier change was a modest decline of just 359 for-hire carriers

This balance suggests the recent rate surge is unlikely to immediately translate into a structural capacity shift—though March typically brings stronger new entry.

Diesel and Costs: Turning Back Up

Fuel and operating costs are beginning to firm again:

Fuel and operating costs are beginning to firm again:

- Diesel prices rose for a third consecutive week, reaching $3.68 per gallon

- Crude prices briefly moved above $65 per barrel in late January

- Trailer prices and key inputs like aluminum reached record highs in December

These cost pressures add another layer of complexity for fleets trying to interpret whether recent spot gains are opportunity-driven or purely reactive.

Macro Signals Remain Mixed

Outside trucking-specific indicators:

- Mortgage rates held steady near 6.1%

- U.S. goods imports rebounded sharply in November while exports declined

- Wholesale inventories tightened relative to sales, reaching their leanest levels since mid-2022

None of these signals point to an immediate demand inflection—reinforcing the idea that recent trucking volatility is event-driven rather than cyclical.

Bottom Line

Episode 350 underscores a critical reminder for the freight market: short-term shocks can create extreme pricing signals without changing the underlying trajectory. The winter-driven surge in spot rates is meaningful, but it does not yet signal a sustained market reset.

FTR subscribers can track these developments in real time through the Trucking Update and Truck & Trailer Outlook reports. Together, they provide weekly insight into spot and contract market conditions, fleet capacity, equipment demand, production, and the macroeconomic forces shaping freight and equipment decisions over the next 24 months. Click on either image below to learn how these products can help your bottom line in 2026.