Holiday Slowdown, Traffic Shifts, and What to Watch as 2025 Closes

The latest episode of FTR’s Rail & Intermodal Update offers a concise snapshot of rail market conditions as we move through the holiday period. While industry news remains limited, several notable shifts in carload and intermodal activity provide important context for transportation planning. This week’s discussion centers on the Union Pacific–Norfolk Southern merger timeline and the most recent freight traffic trends across North America.

Merger Activity: UP–NS Filing Delayed but Still Expected in December

Union Pacific has delayed the submission of its formal merger application with Norfolk Southern to the Surface Transportation Board. Originally expected in early December, the filing is now more likely to be submitted the week of December 15.

Union Pacific has delayed the submission of its formal merger application with Norfolk Southern to the Surface Transportation Board. Originally expected in early December, the filing is now more likely to be submitted the week of December 15.

Once the application is submitted, the STB will have 30 days to determine completeness—likely prompting a period of limited updates as the review begins. Industry sentiment continues to split, with industry participants expressing both strong support and objections regarding the potential consolidation.

FTR will be on-site at the Midwest Association of Rail Shippers Winter Meeting in Chicago, January 13–15, where Joseph Towers and Derek Young will be available for industry discussions, client meetings, and strategic conversations about the freight outlook.

Traffic Summary: Mixed Performance Entering the Holiday Period

The week ending November 29, 2025, produced a mixed picture across carload and intermodal volumes. As we dive into the details, keep in mind that this captures the week of Thanksgiving, and as such we should take these findings with a grain of salt.

Traffic Summary:

- Total rail traffic: –0.5% Y/Y

- Carloads: +3.1% Y/Y

- Intermodal: –3.7% Y/Y

Despite the soft headline number, carload performance strengthened meaningfully compared to recent weeks.

.png?width=1080&height=1080&name=11%20Podcast%20Graphics%20-%20Updated%205.28.24(1).png)

Don't miss an episode!

Rail Market Update Podcast

Carloads: Strength in Key Sectors Offsets Industrial Weakness

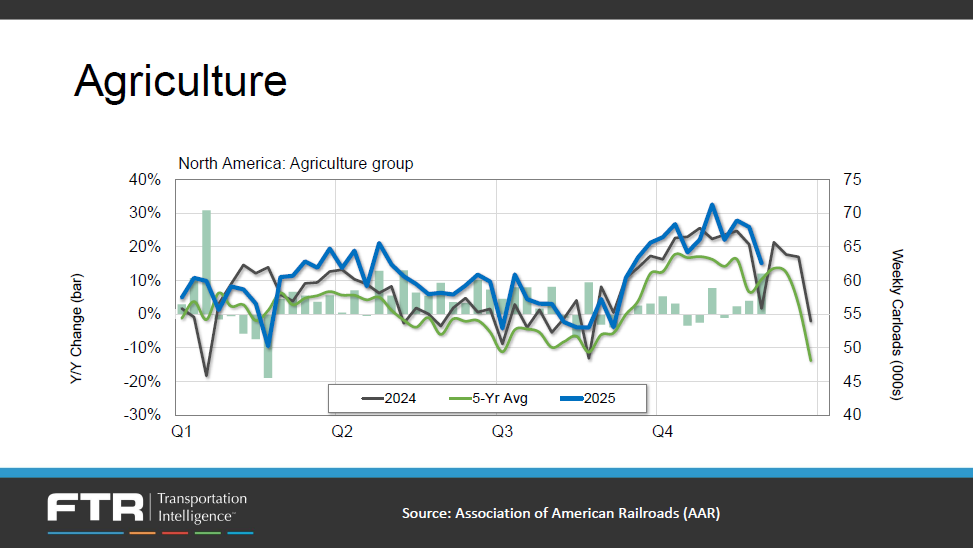

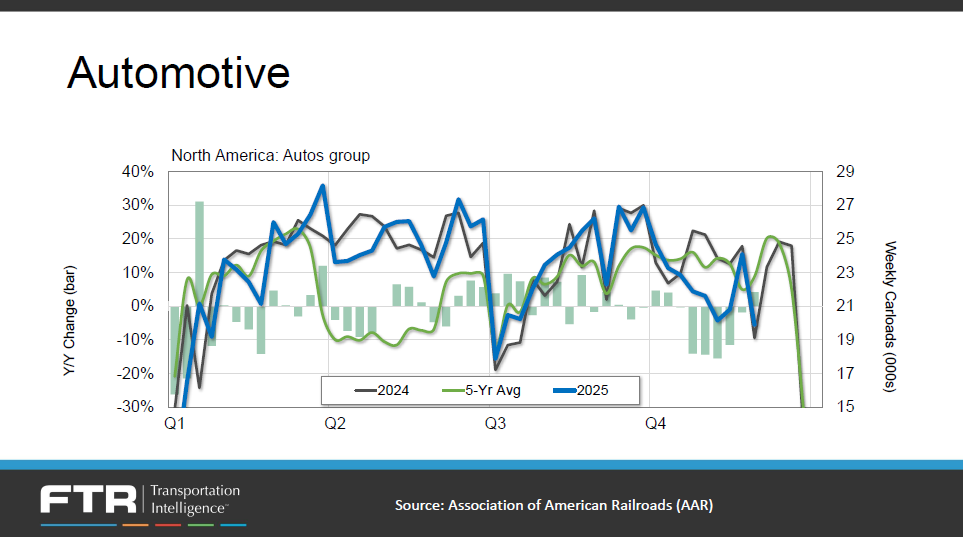

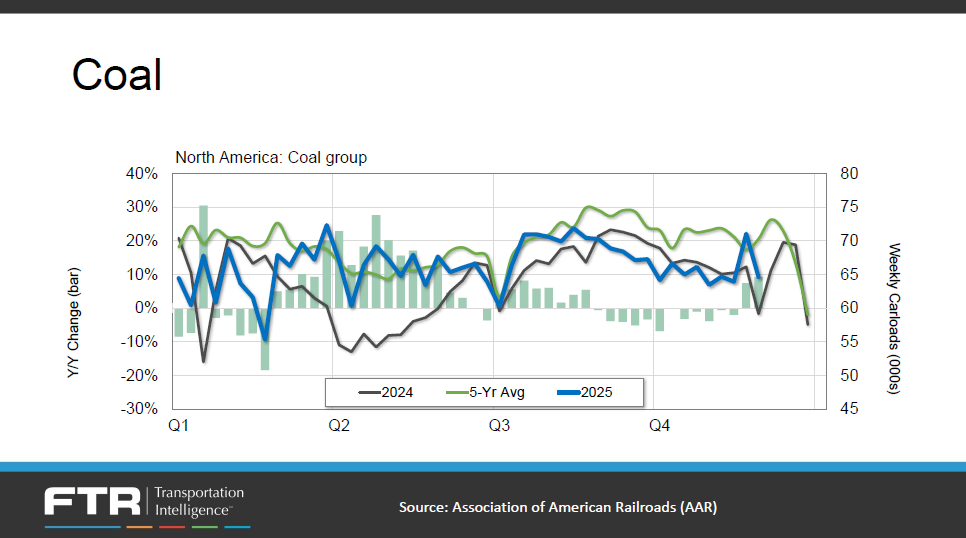

Agriculture, Autos, and Coal Show Momentum

Several major groups posted strong year-over-year gains:

-

Agriculture: +12% Y/Y, driven heavily by grain shipments

-

Automotive: +4.2% Y/Y, breaking a six-week streak of declines

-

Coal: +9.3% Y/Y, marking the second consecutive week of growth after ~3 months of declines

Industrial Commodities Continue to Contract

- Forest products: –8.7% Y/Y

- Metals: –5.6% Y/Y

- Chemicals: –1.8% Y/Y

These segments remain under pressure from a sluggish industrial economy and tariff-related impacts. Slide visuals on pages 12–13 highlight the downward drift in forest products and metallics.

Intermodal: U.S. Weakness Persists as Canadian Volumes Normalize

Intermodal activity has retreated after a brief period of distortion from easy Canadian year-over-year comparisons caused by the 2024 port strikes.

- North America Intermodal: –3.7% Y/Y

- U.S. carriers: –6.5% Y/Y, with all but CSX posting declines

- Canadian carriers: +2.1% Y/Y, driven by CN

- Mexico (GMX): +19.4% Y/Y

While the gains in Mexico are strong, GMX has made significant revisions in their recent submissions, making trend interpretation challenging.

Trailer volumes remain in deep contraction, consistently running 20–30% below prior-year levels.

Looking Ahead

With the holiday period underway, operational noise will continue to distort weekly data. Meanwhile, the industry’s attention will be fixed on the UP–NS filing and the STB’s initial response—which will shape the narrative and set the stage for what to expect in 2026.

Stay Connected

For deeper analysis or to explore how these shifts could influence your transportation strategy, connect directly with:

Joseph Towers, Senior Analyst – Rail & Intermodal

jtowers@ftrintel.com